Why not try them both out?

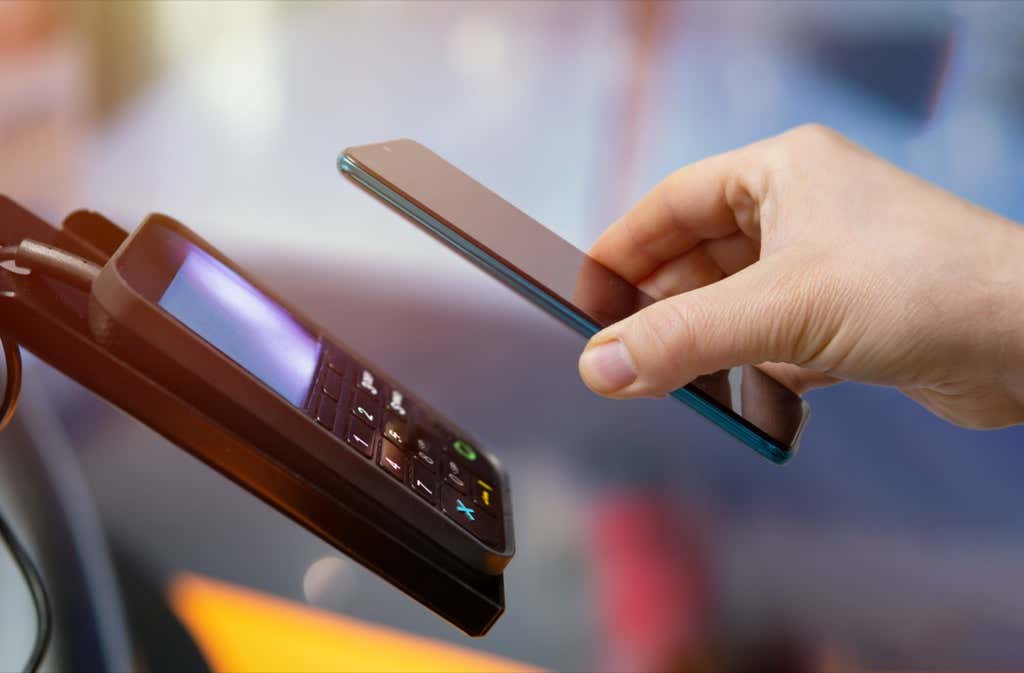

Contactless payment apps offer a safe, convenient way to pay by smartphone. For non-iPhone users, there are two major players in this space—Samsung Pay and Google Pay.

In this article, we’ll list the features of and differences between Samsung Pay and Google Pay and describe which mobile payment app is most worth using.

What Is Google Pay?

Google Pay, formerly known as Android Pay, is a mobile payment app that you can use to make purchases, as well as send and receive money. To use it, all you have to do is unlock the phone and tap it against the contactless payment terminal.

Here are the features of Google Pay:

- Wide availability. Google Pay is available in 42 countries which is second only to Apple Pay.

- Peer-to-peer payments. Easily send and receive money from your friends and family with Google Pay Send. All you need is an email address. However, P2P does come with added fees, and the service is currently only available in the US.

- Wide support for credit and debit cards. Google Pay supports most major credit cards and payment services, including American Express, Discover, MasterCard, Visa, and AMEX. It also supports most major banks – check the list on Google’s support page. Google Pay also makes it possible to pay via PayPal.

- Google Wallet stores your passes and cards. Google Pay allows you to store loyalty, membership, and gift cards, as well as travel passes, tickets, and account cards in one place.

- Support for Wear OS smartwatches. You can install and use the Google Pay app via your Wear OS smartwatch. It just needs NFC (Near Field Communication) capabilities.

- Google Pay offers. You can opt-in to Google Pay rewards and receive exclusive offers, collectibles, promo codes, etc.

- Added security. Google Pay uses industry-standard tokenization and NFC technology to send encrypted data to merchants, making it more secure than traditional credit cards. The app also allows fingerprint scanning or facial recognition access, and there are limits to the amount that can be purchased or sent via the app.

Where Google Pay Falls Short

Google Pay is packed with features, and for most users, it is a perfectly suitable app. However, it has a few shortcomings, including:

- Limited features outside of the US. P2P support is only available for users within the US, which is bad news for international users.

- Cluttered UI. The revamped Google Pay app has received substantial criticism for its confusing layout. Making payments is easy enough, but sorting through the cards in your digital wallet can be difficult.

- Google Pay is not always accepted. Though most stores now support Google Pay purchases, some do not. You still need to carry around a secondary payment method, which for some people, removes the entire point of having a contactless payment app in the first place.

What Is Samsung Pay?

Samsung Pay is a convenient one-tap contactless payment and digital wallet app available to Samsung phone owners. A simple swipe up from the lock screen opens your payment options, allowing you to pay instantly.

Recently, Samsung Pay has overtaken Google pay as the second-largest mobile payment app (behind Apple Pay, the most popular app).

Features of Samsung Pay:

- Availability in 29 countries. While this is fewer countries than Google Pay supports, the list is constantly growing.

- Support for most major credit and debit cards. Samsung Pay supports most major payment platforms, including all major credit card companies. The full list is on their support website. Samsung Pay also offers support for PayPal payments.

- Samsung Rewards. With Samsung Rewards, you can earn points for each purchase you make while using the app. These points can be redeemed to make purchases using the Samsung app (or on the Samsung website).

- Mobile wallet for cards and passes. Store and use gift cards, membership cards, and loyalty cards with the app by scanning the card’s barcode. Samsung Pay also allows you to create a digital wallet, including creating a verified Vaccine Pass from your vaccination documents.

- Compatible with Samsung smartwatches. Some Samsung Galaxy wearables support Samsung Pay, including the Gear S3, Galaxy Watch3, and Galaxy Watch Active2.

- Supports both NFC and MST (Magnetic Secure Transmission). MST technology allows your Android phone to communicate with older magnetic stripe card readers that require you to swipe a card. However, support for MST is being removed as of the Galaxy S21.

- Added security. Your Samsung Pay details are protected by Samsung Knox and tokenization. Like Google Pay, your card information isn’t sent to merchants. Further, Samsung Pay allows you to use Find My Mobile to remotely lock your account or remove the app from your mobile phone. The app also supports fingerprint and facial recognition authentication.

Where Samsung Pay Needs Improvement

While Samsung Pay meets the major requirements of a contactless tap-as-you-go payment app, it has three significant drawbacks in functionality.

- Limited compatible smartphones. Samsung Pay is only available on Samsung smartphones and does not work on other Android models. If you decide to buy a non-Samsung device, you’ll have to set up Google Pay (or another alternative) as Samsung Pay won’t be available. Despite this limitation, Samsung Pay has more active users than Google Pay.

- An annoying number of ads and pop-ups. A common frustration for Samsung users is the gradual introduction of ads into the native Samsung apps, which holds true for Samsung Pay. Many users complain that intrusive ads even pop up during the payment process.

- Removal of MST support. While more and more places are getting on board with NFC terminals, many still use MST. The last Samsung models to support MST payments were the Samsung Note 20 series. Unfortunately, this was the main reason many users decided to use Samsung over Google.

Samsung Pay vs. Google Pay: Which is Better?

Samsung Pay and Google Pay are similar in terms of the service they provide and payment methods they support (including online payments). Still, Google Pay supports more devices and is available in more countries.

The main reason to choose Samsung Pay is if your area still mainly uses MST terminals. In that case, you won’t run into the issue of being unable to pay with Google Pay. However, with NFC technology becoming more popular (and Samsung withdrawing support for this), it isn’t a deciding factor.

Google Pay offers peer-to-peer payments in the US, which can be helpful in many situations and helps to cut down on the number of apps you need. This is possible with Samsung, but you need to sign-up for Samsung Pay Cash as well.

Another major reason to choose either app is the other accessories you own. For example, if you have a Samsung smartwatch, you’re better off going with Samsung Pay.

Which Should You Choose?

Both Google Pay and Samsung Pay are great choices if you want to move into the world of all-in-one contactless payment and card wallet apps.

Since the two apps are so similar, we recommend installing both (they’re both free to set up) and trying them out. This way, you’ll get a feel for each, and you can decide on the app which fits your preferences.